Refinancing a home is an old practice that many people utilize in their lifetime. When you refinance a home, you are committing to take out an additional loan on your home in order to receive cash. It is comparable to a personal loan, but instead, the payments are simply a part of your mortgage. This common practice has been used by homeowners for ages, and now, mobile homeowners can get these same benefits.

What Is A Refinance Program?

A refinance program is a specialized program designed to help homeowners take advantage of the perks of refinancing. These programs are aimed at individuals who want to benefit from a refinancing option. Different programs can offer you different agreement details and different perks.

Our programs are aimed to provide maximum customer benefits while also helping us to help you. We benefit from customers refinancing financially, and our customers benefit quite a lot too.

A good refinance program should always leave a customer better off than their previous loan. Depending on your needs, we can tailor our refinance options to ensure that you are able to thrive and gain plenty from your newly refinanced loan

Why Should I Refinance?

Refinancing is a popular option specifically because it allows a variety of different benefits. Depending on your situation, you might refinance for financial reasons or to give yourself the ability to do something that you think will improve your home or your life. Many different people refinance, and almost all of them do so for different reasons.

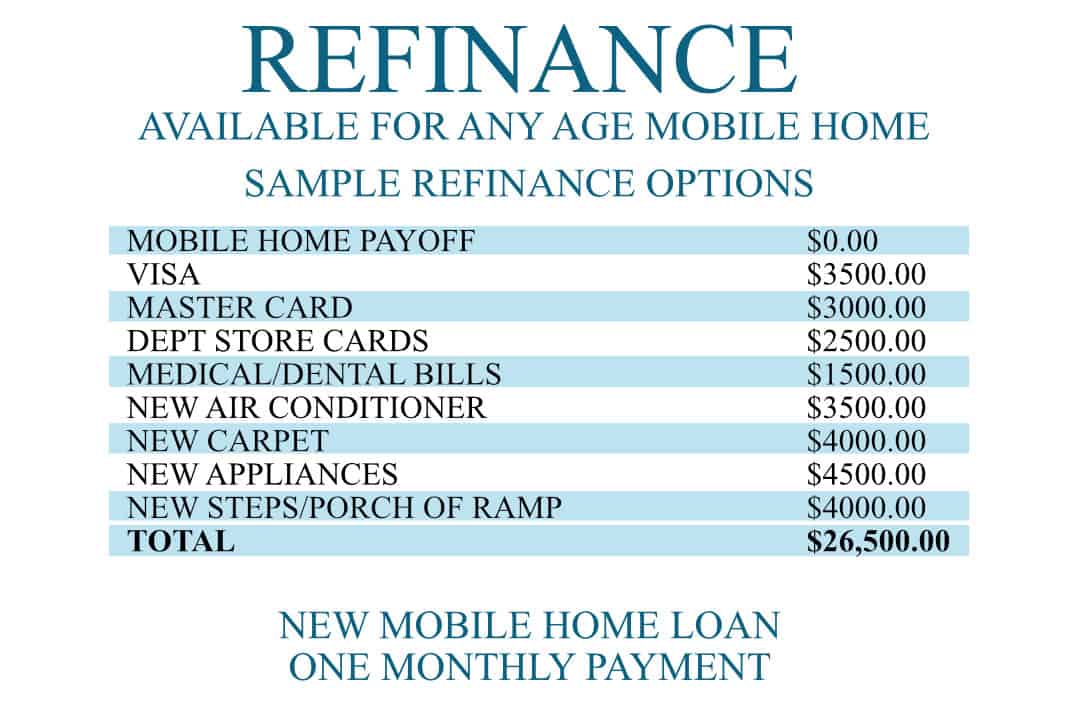

A primary reason to refinance your mobile home is simply to gain money for yourself. More often than not, when you refinance, the additional money being placed on your loan will actually go to you. People use this money for many great outcomes.

One of the more popular reasons to refinance a mobile home is to more feasibly fund home renovations. Renovating your home can be a costly expense. When you refinance, you will be able to pay for the renovations upfront and then distribute the payments out across your mortgage payments. This allows you to carry out renovations immediately without forcing you to use up your entire savings to do so.

Life can be unpredictable and sometimes unfortunate circumstances find us. Another reason that many refinance their homes is to effectively navigate unfortunate life events. Refinancing can give you the ability to more easily pay for unexpected bills, like medical bills. It can also give you much-needed money to help cover other bills or even your mortgage in the event that you or a loved one finds themselves out of work. This is a great option to make navigating hard times much more manageable.

In addition to gaining cash in hand, refinancing can also be right for you if you are not satisfied with your current loan arrangement. It is fairly common for people to refinance through a new lender to gain a better contract or to take advantage of certain perks with the new lender. Many people have been known to find that their original arrangement really wasn’t very good compared to what is available. Refinancing can help you to secure a loan that you feel comfortable with.

Many people also refinance to better manage their personal debt. It can be difficult to juggle several high monthly payments, which is what makes refinancing great. Refinancing your home can be a wonderful alternative to getting a consolidation loan. It can save you money each month by giving the cash to pay off certain debts. In many instances, people who find themselves with high-revolving debt find a great amount of reprieve with this decision.

Refinancing can be the right decision for someone for several different reasons. In fact, refinancing is often a better alternative to problem-solving when it comes to personal finances. Refinancing your mobile home can help you to gain more and might be the helping hand that you have been looking for. Whether it is a necessity or simply to have more in savings, we are happy to help.

What Are The Benefits of Refinancing?

Refinancing is a favorable option because more often than not, the individual is simply getting a better deal. The reason that you refinance really doesn’t matter because at the end of the day, you will do so to gain certain benefits. Depending on your needs and preferences, different refinancing options can help you to gain access to some truly wonderful perks

Lower Monthly Payments

One of the biggest benefits of refinancing is that in many cases, you can actually lower your monthly payment. Your monthly payment is often determined by the size of your loan and your interest rate. Since your loan will often be smaller and the terms will be renegotiated, it is incredibly possible for you to actually save money each month by refinancing your mobile home.

Monthly payments can be incredibly high, particularly when you are on a fixed income. If you would like to have lower payments so that there is more freedom in your finances each month, this is something that can be arranged using our refinancing options. A lower monthly payment can significantly boost quality of life, making it easier for you to find some extra room in your monthly budget without having to rely on credit cards.

Lower Interest Rates

Interest rates have been known to change substantially over the years. In many cases, people find that the interest rate on their original loan is quite a bit higher than on newer loans. This means that when you refinance, you will end up with a much lower interest rate.

Interest rates determine how much extra you ultimately end up paying for your home. The interest is stacked on top of the loan and will determine the overall cost of borrowing the money. A lower interest rate is a great thing because it means that you will ultimately save quite a bit more. Not only can you end up with a lower monthly payment, but you can actually save quite a bit of money over the years.

Many homeowners are shocked to realize just how little of their monthly payments actually go towards their homeownership. In many instances, people are paying on their homes for a long amount of time purely because of interest, and that money is not actually going towards their investment until the interest is completely paid off. When you refinance, you can feel confident know that more of your money is going towards owning your home.

Better Terms

As a lending company, we feel very strongly about the fairness of our loan terms. However, that is not the case for every lending company out there. In some instances, mobile homeowners have found that the terms of their arrangement with their old lending company are actually fairly awful.

In some instances, it might simply be that the original agreement lacked some of the benefits of modern loan agreements. While this isn’t the worst, it does mean that you are missing out on the perks of a new lending agreement. When you refinance, you can more readily discuss those conditions and get some added benefits for yourself. There are all kinds of great new options in modern lending and we like to make sure that our clients are well and truly going to benefit from the new agreement.

The fact is that some people also find out that the agreements that they entered into are really not in their best interest. Homeowners are not always aware of what is and is not considered common in a lending agreement. Most people can only make the assumption that their agreements are fair, which is unfortunate since some companies know this and take advantage of it. Fortunately, refinancing makes it possible for you to arrange a better agreement that is mutually beneficial for you and Santiago Financial.

Pay Off Debt

Some of our clients refinance with us specifically with the intention of paying off other forms of debt. Credit card companies are notorious for tricking customers into high-interest agreements that ultimately do more harm over time. The slippery slope of credit card use can force you to rely even more on credit to ensure that your needs are being met. When you refinance with us, we can help you to pay off other forms of debt completely, which can lower your monthly payments and save you a significant amount of money on painfully high interest rates.

Boost Your Credit

When used correctly, refinancing can actually improve your credit. You might wonder how entering a new lending agreement can improve your credit, and the secret is in how you use your money. More often than not, refinancing will allow you to more easily pay your monthly bills and can eliminate debt entirely. When you pay off your other debt accounts, you will generally receive a nice boost to your credit score. Pairing this with a loan agreement, which is generally great for credit, can help you to benefit in the long run.

Paying off high-interest debt is a great way to improve your credit score. Not only can you relieve your credit history of high-revolving debt, but you can also demonstrate to future creditors that you are reliable and will follow through on your agreements. This is great for your credit score and demonstrates that you are a good person to lend to.

Pay Your Mobile Home Loan Off More Quickly

It might sound counterintuitive to pay for a shorter duration by entering a new mobile home loan, but it is incredibly common. Many people are known to commit to a long-term mortgage that can take years to pay off. Since that is the agreement, you will be stuck paying that amount for that duration of time. The longer that you spend paying, the more money you will ultimately be spending on interest. This is very bad because it means you will actually lose money.

When you refinance, you are given the opportunity to once again choose your loan length. This means that you can easily change the terms to pay the loan off more quickly so that you lose less money to interest and can comfortably pay off your mobile home as soon as possible. With this approach, you can save money and commit to your dream home more quickly!

Transfer Home Ownership

Sometimes you will sign into a mortgage with someone and find out later that it simply isn’t working out. These things do happen, and refinancing is a great way to tie up the loose ends.

In the event that one of the individuals would like to be removed from the loan agreement, refinancing is a quick and easy way to transfer ownership to one party instead of leaving it in both names.

At the same time, you can also do the opposite and add someone to the home loan in the event that your circumstances have changed in a positive direction.

How Santiago Financial Can Help

The team at Santiago Financial is composed of trained individuals who are prepared to help you get the most out of your lending experience. We are proud to offer a wide range of mobile home refinancing options to ensure that you are always happy with your lending agreement.

If refinancing is something that you have been considering, we would love to hear from you. Our team is composed of industry professionals who know how to get you the best possible deal. When you reach out to us for a consultation, we will be able to provide you with a custom experience that will help you to get exactly what you want out of an agreement.

We are an established team of professionals who have been working in the industry for decades. With our knowledge of the industry and lending opportunities, we are prepared to work with you to find the best possible refinancing option. Don’t hesitate to reach out and see how we can help better your financial situation!

RATE AND TERM REFINANCING

- Any Age Mobile Home

- Refinance Existing Balance Only

- Possible Reduction in Monthly Payment

- LTV based on Original Purchase Price or Current Appraised Value – whichever is less

- Mfd/Mobile Homes in Parks and on Land

Program II

- Mobile Home June 13, 1976 or Newer (Post Hud)

- Refinance Existing Balance Only

- Possible Reduction in Monthly Payment

- Loan not to exceed 80% of Current Appraised Value

- Current Loan must be Reported on Credit Report

- Loan must be Seasoned for 12 months

- Mfd/Mobile Homes in Parks Only

LAND/HOME CASH OUT REFINANCING

- Any Age Mobile Home

- Manufactured / Mobile Homes on Land Only

- No Co-Op Land Ownership

- Permanent or Non-Permanant Foundation

- LTV based on Original Purchase Price or Current Appraised Value – whichever is less

CASH OUT REFINANCING

- Any Age Mobile Home in Parks

- Refi: Home Improvement, Debt Consolidation, Pay Space Rent, Cash in Hand Limitation

- LTV based on Original Purchase Price or Current

- Appraised Value – whichever is less

Best Rate Program:

- Homes 20 Years or Newer, Max Cash Out $25000

- Cash Paid Directly to Creditors, No Cash in Hand

- Loan not to exceed 65% of Current Appraised Value