What It Is

Manufactured home appraisals or property valuations are the process of determining the market value of a manufactured home. Appraisal reports are used in manufactured home loans. Appraisals are most frequently used in purchases and sales of manufactured homes but are also commonly used in refinances.

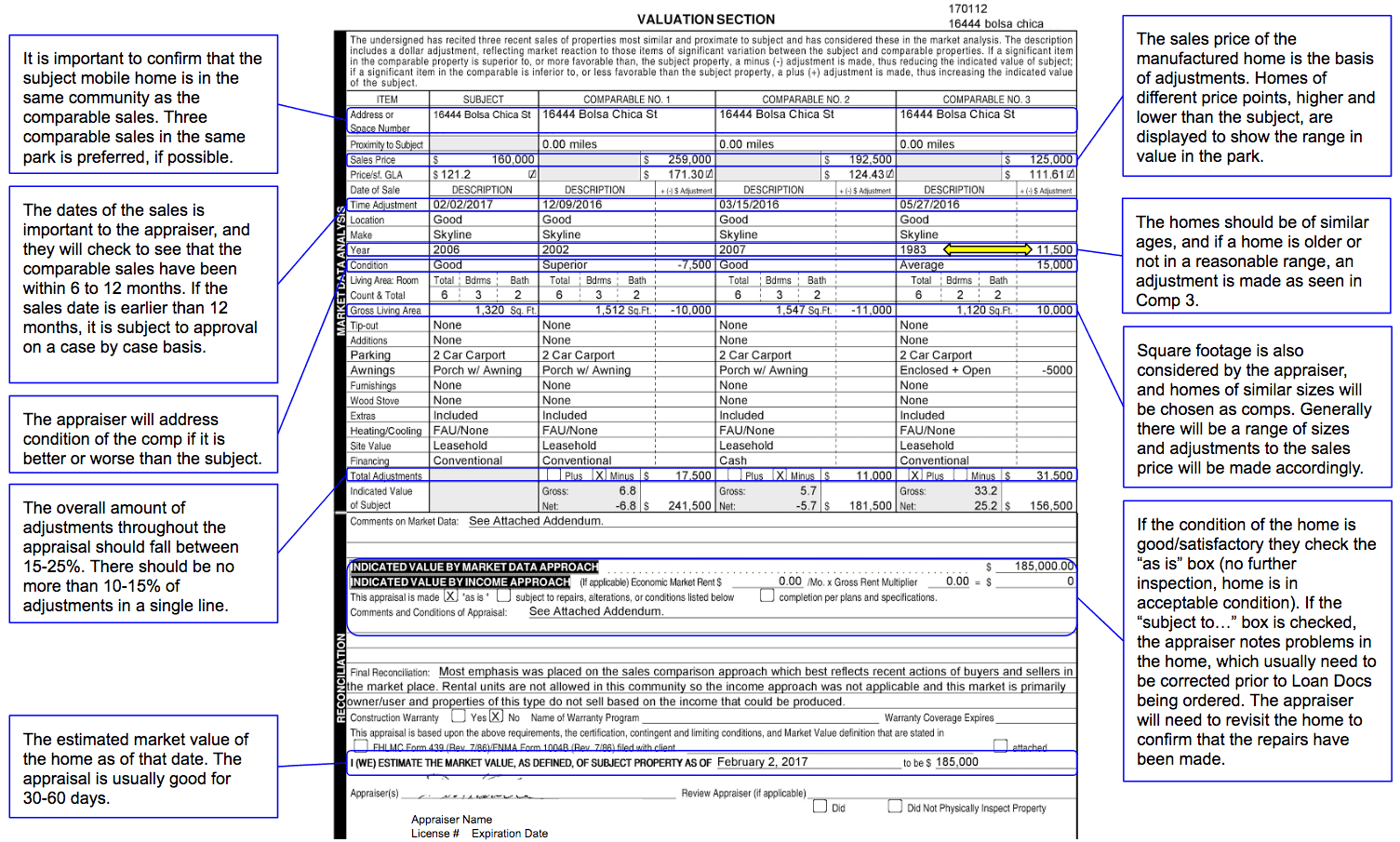

Sample

(Click to zoom)

Why We Need It

Appraisal reports are used in mortgage loans, settling estates, establishing a sale price, and taxation. The amount the manufactured home is estimated to be worth by an appraiser’s physical inspection of the home. This value affects the loan amount our underwriters approve the buyer(s) for. An appraisal also gives the homeowner a good estimation of the value of their home. In the case of purchases and sales, the appraisal is used to determine that the home’s contract price is correct given the location, condition, and features. For refinance cases, the appraisal assures the lender that the amount being loaned is not greater than the home’s value.

What We Look At

An appraisal review checks that the personal information and home information is correct on the documents as well as basic items about comparable sales. Appraisal value is calculated using comparable sales from the last six months in the park or community and takes into account physical aspects of the home. An appraiser will evaluate all aspects of the home and considers the age, location, quality, square footage, number of rooms, etc. of the home and creates an appraisal value from this information. Anything added to the home such as carpets, porches, awnings, air conditioning, etc. are all taken into account in the appraisal report.