Debt and housing ratios are two important factors taken into account when qualifying for a loan. In part one, we will explore housing ratios:

Housing Ratios (Front-End Ratios)

The housing ratio is used to assess how much income is needed in order to adequately repay your loan. Lenders will look at the housing ratio as a measure of risk. The higher the housing ratio is, the higher the risk that a buyer may default on payments on their loan. Typically, we try and keep the housing ratio in a range of 32-35%.

For manufactured homes, the housing ratio can be calculated using three different figures.

- Monthly home payment (This includes: P&I, TAX IMPOUNDS und INSURANCE IMPOUNDS.)

- Monthly space rent (This amount will vary depending on the Mobile Home Park

- Gross monthly income (How much you make per month before taxes)

With these three components, we can calculate what percentage of housing ratio you will have.

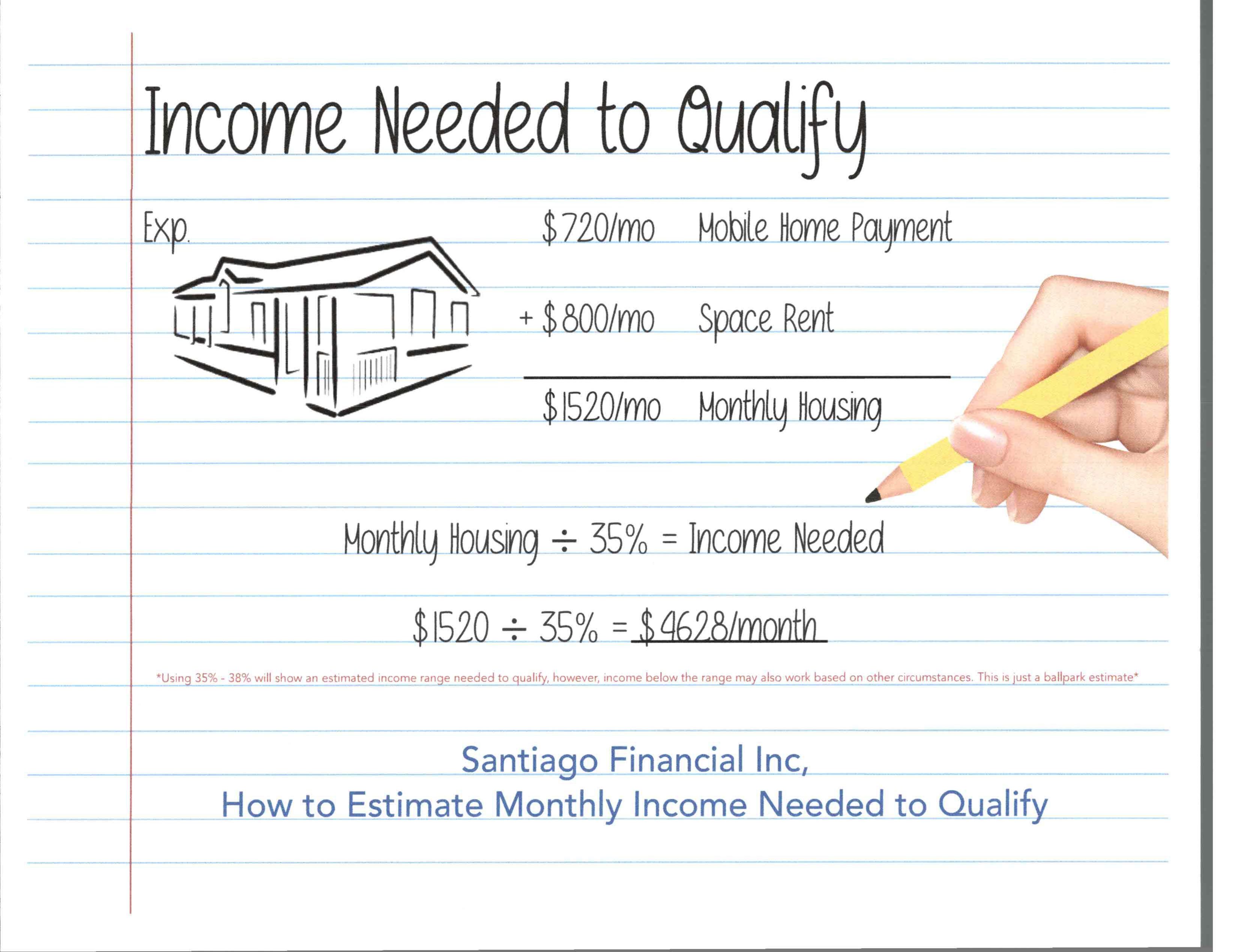

For example, lets say your monthly home payment is $720 per month, your space rent is $800 per month. We’ll use $4,350 as your income. To find your housing ratio, all you need to do is add, then divide.

Housing Ratio (35%)= ($720+$800) ÷ $4,350

By looking at the diagram below, we can see how much income is needed to qualify at a 35% housing ratio.

If you want to find out how much of a monthly payment you can afford, simply take your income and multiply it by 35%.

Lenders may allow for a higher ratio based on disposable income. For more information on disposable income, find out more about our loan programs and to see if you qualify for a manufactured home loan, contact our office at 714-731-8080. You can also reach out to us via email at info@santiagofinancial.com